Like many businesses, this small chocolate brand has dealt with challenges due to inflation over the past few years. Learn the system that is helping them adjust their processes and prices to adapt.

Whether you’re a consumer or a company leader, it’s hard to go a day without feeling the effects of inflation. According to the U.S. Chamber of Commerce, inflation has been the top concern for small businesses every quarter for the past two years. If you’re a small business owner, I’m sure I’m not telling you anything you don’t already know.

Unfortunately, rising costs are nothing new for my artisan chocolate company, Harlem Chocolate Factory. My team and I dealt with it during Covid, when dairy output went down, and costs went up. We dealt with it a couple of years ago when our packaging manufacturer shut down, and the rest of the industry prices had gone up nearly 200 percent.

Frankly, like so many bootstrapped businesses, we have been underfunded since the moment we opened, especially considering I want to keep our prices as reasonable as possible given the minority community we serve.

The silver lining of this ongoing challenge is that we’ve developed a strong system for assessing our financial realities as costs change around us and creatively adjusting our products, processes, and pricing to keep our business successful for the long game. Here’s how.

We broke down exactly where our money was coming from and where it was going

The first step in making an informed decision about how to react to inflation was getting a detailed understanding of how it was actually affecting our business.

This meant diving into our accounting software (I use and swear by Intuit QuickBooks) and comparing COGS (cost of goods sold) to sales for each of our SKUs so we could identify any areas of financial bleed. I immediately realized we needed to get more granular in our accounting for this to be a helpful exercise, breaking out how much of each ingredient goes into each product and even how much time each product takes to produce.

So, I pulled out every receipt and divided up how much of each ingredient went into each product down to the gram. I brought an Apple Watch to work so I could quickly start a timer every time I switched tasks and accurately track time spent per product. I made sure we were including costs like packaging and employee labor, too.

It was a heavy lift at first, but once the work was done, it was a matter of a few clicks in QuickBooks to help us identify problem areas. Now, I always tell other business owners that if you’re looking for a place where you’re losing money, it’s trying to do your accounting through Excel.

You need a multidimensional, dynamic accounting software like QuickBooks that pulls data from every area in order to make these decisions. Even if it costs you a little extra time and money upfront, you’ll make that back easily with the savings you can identify.

QuickBooks has been my CFO throughout my entire business journey. There is no way I would have been able to run my business through these economic ups and downs without it.

We found cost savings in the business first

With these reports in hand, my next goal was to look for places where we could stop the money siphoning out internally before I even considered raising prices.

This meant identifying products that were not scalable in our current state, even if they seemed successful. For example, our chocolate turtles were one of our most beloved products. People came to the store specifically for them, they would sell out as soon as we stocked them, and customers would bite into this product and cry (no joke). As a business owner, that product felt wonderful, and my gut would tell me never to cut it.

But that’s why it’s critical to make these decisions based on actual numbers and not a gut feeling. Looking at the reports, I could see clearly that these turtles took us three days to make about 90 of them — which could make sense if we could charge $10 a turtle, but there’s a cap on what people will realistically pay.

I could see that making them meant we had to keep pecans on hand (which we didn’t use for anything else) and required more flaky sea salt than other products, adding to our costs.

I could see that, even though they consistently sold out, we had only made a total of $11,000 from them over the course of three years because of the limited output we were capable of producing.

We ended up cutting them, along with about 30 other products, reducing our SKUs down to five items I knew we could consistently turn a healthy profit on.

Looking at these reports, I also saw opportunities to adjust staffing. For example, at the time, we were open six days a week, but the bulk of our in-store orders were happening on a single day.

I decided to cut down our retail hours to weekends only, devoting the other work days to corporate gifting and growing wholesale opportunities. I also looked for opportunities to use my higher-paid employees for higher-value tasks, reassigning easier work to someone more affordable.

By finding the money in the business first, I could avoid reaching into the consumers’ pockets — a valuable strategy for building customer loyalty in the long run.

We looked for places where we could raise prices outside of our core product

Even if I had wanted to raise prices on our products, there’s really only so much wiggle room we had, because there’s only so much customers are willing to pay for a piece of chocolate. So, I looked for other areas where I could reasonably adjust prices to make up the difference.

For instance, we decided to up the price of our gift packaging, especially given the increase in packaging costs we had experienced. Most people are prepared to spend a little bit more when buying a gift, and it meant we didn’t have to adjust the pricing of the actual chocolate.

We also realized that a lot of our events were under-priced. We had an offering to come into companies’ offices and set up a mini Harlem Chocolate Factory for their employees.

As a small brand, we were so excited about opportunities like this for brand building that we kept the prices low. However, after realizing how much time and materials went into these events, it was clear we weren’t charging enough, especially because corporate clients are often prepared to pay more than individual consumers.

For most businesses, there are so many ways you make money. So it’s worth getting creative with where you can raise prices before touching the product that people know and love you for the most.

We were upfront about these changes and accepted losing some customers

Communicating these changes to customers wasn’t always easy. When we got rid of the turtles, for example, we would have customers come into the store to ask about them and walk right back out when we explained we weren’t stocking them anymore.

Here’s the reality I realized: When someone’s upset about something, and they just want to be upset, there’s no way of getting through to them. In those cases, I accepted losing the customer for now, though I also suggested joining our email newsletter to be updated when we bring their favorite product back.

But when customers seem open to understanding why we made these changes, I’m always transparent with them. I’m upfront about how, even though it may seem like we’re wildly successful from the outside, it takes hard work and tough decisions to ensure we’re financially sound.

I get granular about the ways our costs have increased and how that impacts different products. I also explain the reasoning behind our pricing, which gives me the opportunity to share the time and quality ingredients that are going into our products.

It’s not about giving excuses or sharing a sob story, just educating customers who may be unaware of the realities of bootstrapping a small business. The people who care, care, and I’ve found that many of our customers are even more excited to support us after getting a peek behind the curtain.

The market is always changing, and this is now a quarterly exercise where we look at our financial reports, search for the bleed, and look for creative ways to adapt.

Sometimes, it blows my mind that our small brand is still here through the ups and downs of the past few years, and I know it’s been because we’ve made informed financial decisions.

Recommended Story For You :

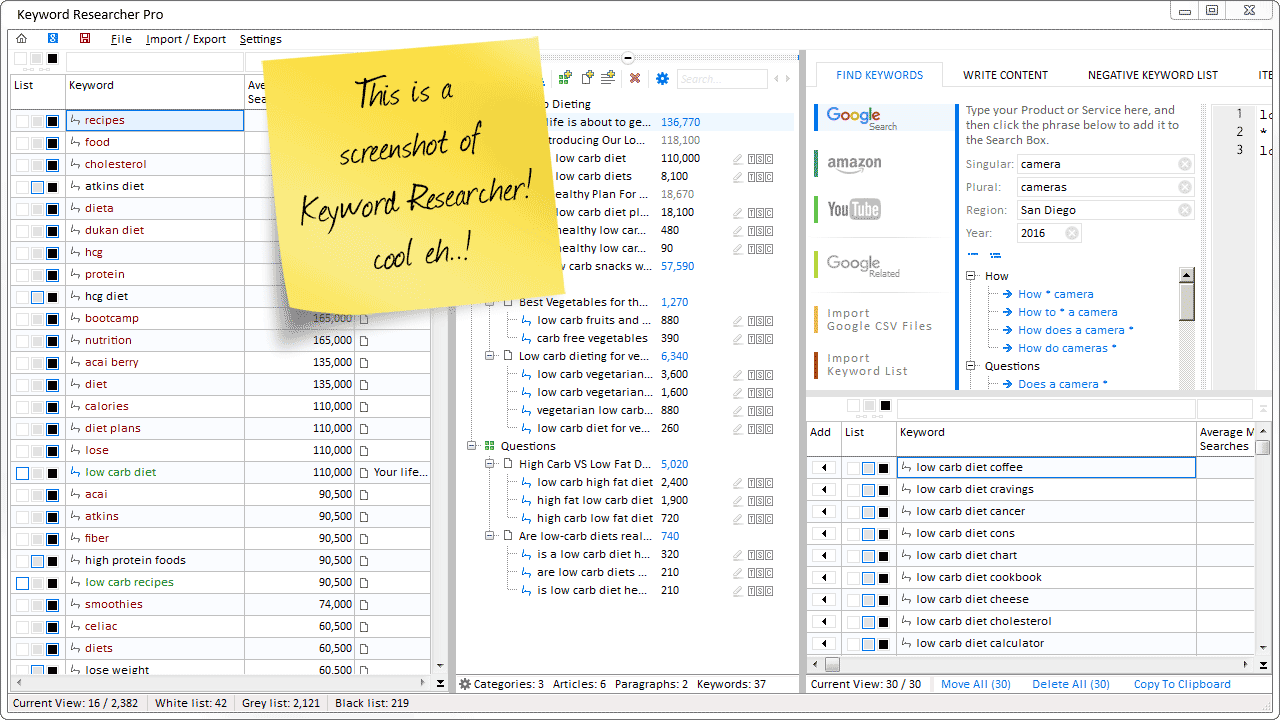

Organize Keywords and Import CSV Files from the Google Keyword Planner

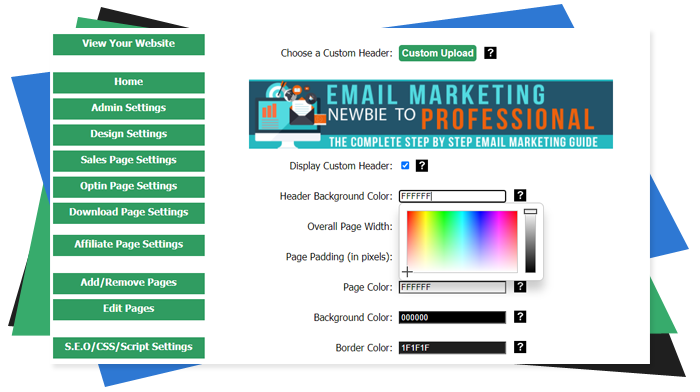

The Most Affordable And Easiest User Friendly Page Builder You Will Ever Use!

Instant WordPress Theme That Matches Your Website

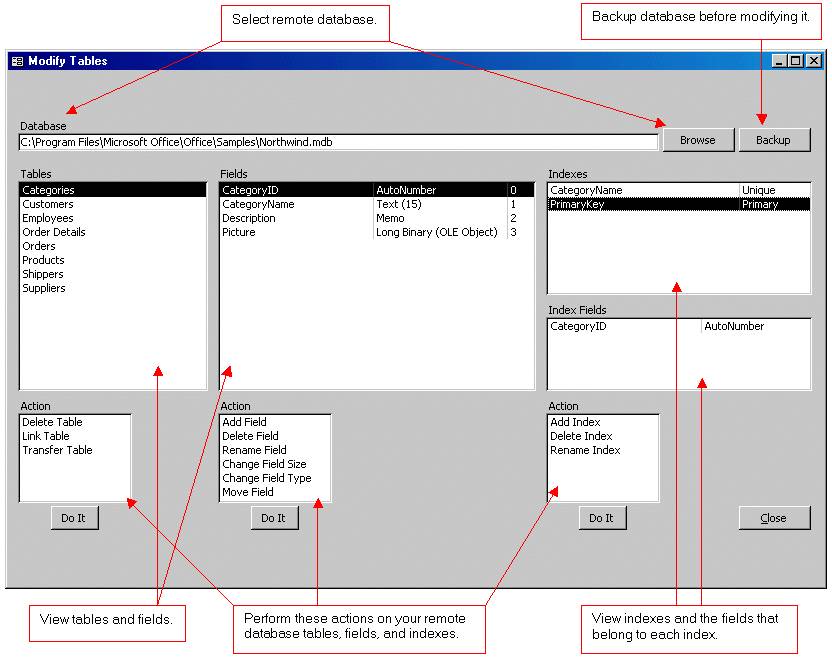

Wizard to Manage Remote Backend MS Access Database Tables Fields and Indexes

If you had an aisle-by-aisle grocery list wouldn't you spend less money on impulse items?

everything you need to create a professional corporate look mini-site is there.

Unlock Your Networking Potential with GNS3Vault

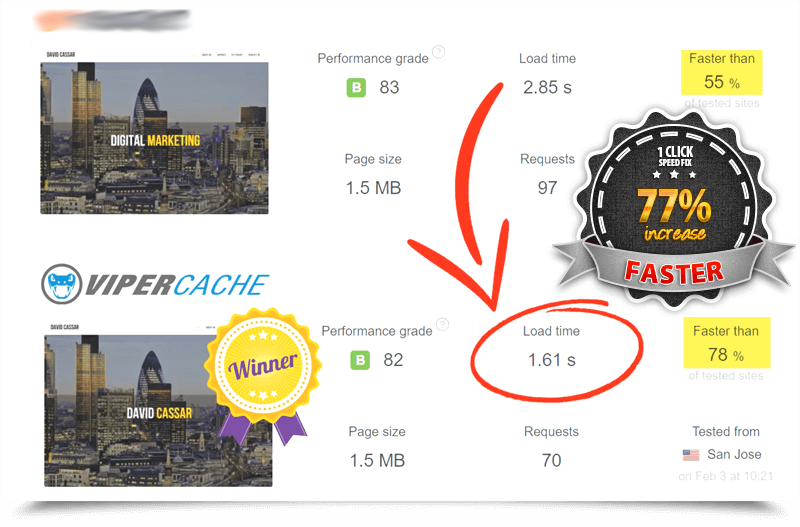

Viper Cache Was 77% Faster Than The Competetion

Understanding Stock Market Shorting eBook